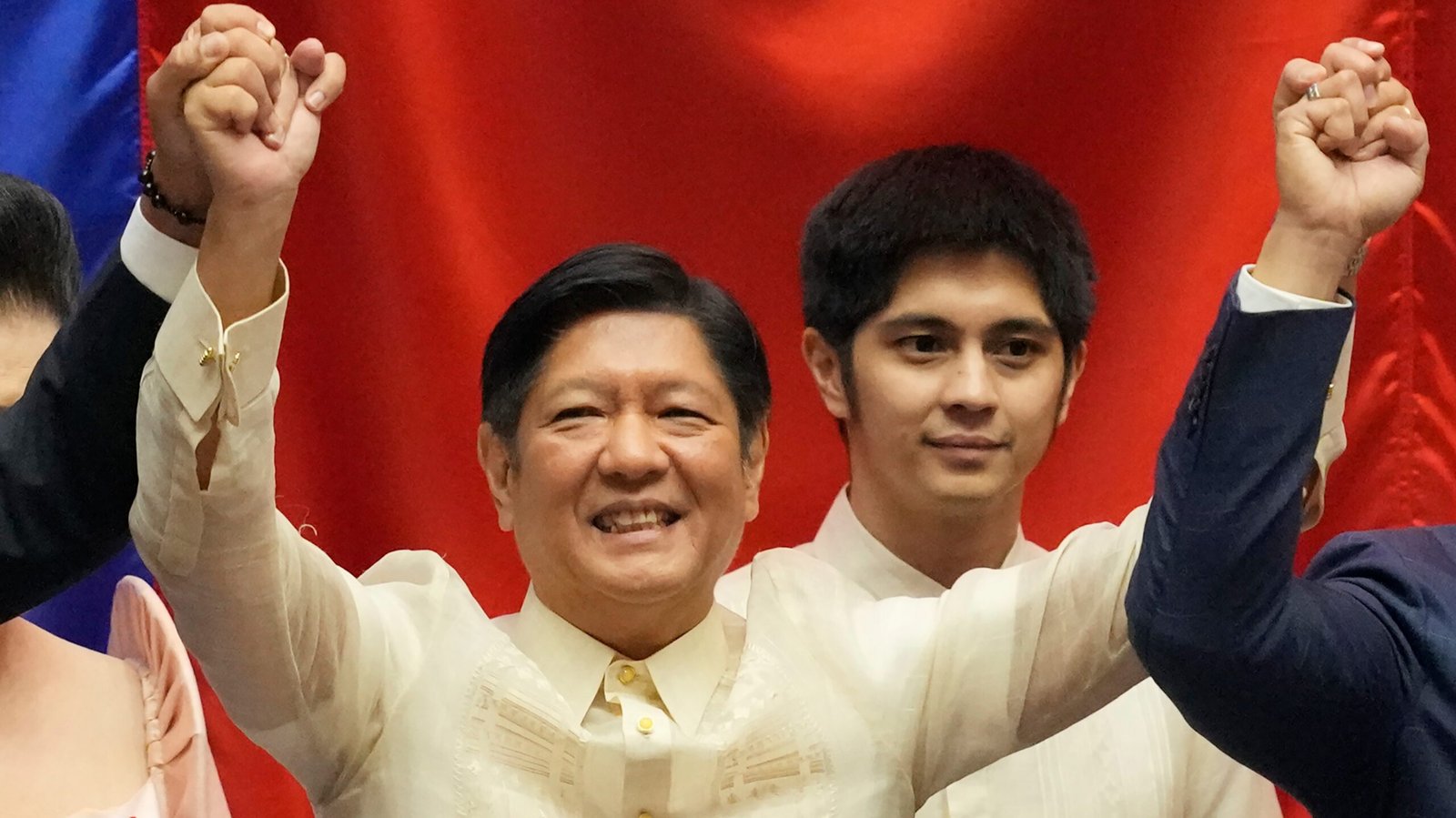

Bongbong Marcos urged to revive dad’s oil price stabilization fund

MANILA, Philippines — President Ferdinand “Bongbong” Marcos has been urged to revive the Oil Price Stabilization Fund (OPSF) — a program placed by his late father during his term to counter the recent wild swings in fuel prices in the country.

In a statement on Monday, 1-Pacman party-list Rep. Mikee Romero said the revival of the OPSF which was initiated in 1984 during the term of late former president Ferdinand E. Marcos will create a buffer fund that can serve as a cushion when fuel prices rise or decrease sharply — just like what has happened in recent months.

Oil companies are expected to introduce a fuel price rollback of around P5 per liter of gasoline and diesel on Tuesday, weeks after hikes that brought pump prices to over P80 per liter of gasoline and P90 per liter of diesel.

“We should revive the OPSF or establish a similar buffer fund, which the government could use to avoid frequent adjustments in the pump prices of oil products due to fluctuations in the cost of crude oil in the world market and in the peso-dollar exchange rate,” Romero said.

The lawmaker, an economist, reasoned that prices currently remain volatile due to the Russia-Ukraine conflict. But with the buffer mechanism, sudden price increases would be shouldered momentarily by the government to avoid a sharp rise in expenses.

This can be a solution if the government does not suspend excise taxes on oil products, including those mandated by the Tax Reform for Acceleration and Inclusion (TRAIN) Law.

“Since the government is not agreeable to the suggested suspension of excise taxes while the cost of crude is above $80 per barrel, we could use part of these impositions as a price stabilization fund to provide relief to the public from increased fuel and consumer prices,” he said.

He hopes Marcos would be open to the proposal especially as it was his father who first initiated the measure.

Romero explained that under the older Marcos’ Presidential Decree No. 1956, issued in October 1984, oil companies would be reimbursed using the OPSF to cover “cost increases on crude oil and imported petroleum products resulting from exchange rate adjustment and/or increase in world market prices of crude oil”.

However, last May, a government think-tank warned against the revival of the OPSF, as it would create more problems than solutions for oil price hikes.

In a study, the Philippine Institute for Development Studies (PIDS) noted that the OPSF would go against the reforms set in the early 1990s regarding oil deregulation.

According to PIDS, under the OPSF, oil companies contributed to the buffer fund when crude prices were low, but took from it when prices were high. This led to a budget deficit as the government had to shoulder most of the costs.